Vayak Add-on Modules

Manual ECS in Co-op Society

Streamline monthly loan and recurring deposit collections by obtaining signed manual mandate forms from customers. Once approved by the bank, monthly installments are automatically processed and collected from the customer's bank account to the society's account.

The system handles auto-posting to respective customer accounts via Excel sheet integration, ensuring accurate record-keeping and reducing manual cash handling efforts.

Vayak Auto E-Collect (UPI API)

Experience a fully automated, paperless collection system leveraging UPI APIs. This advanced solution eliminates manual forms and Excel sheets by sending data online for instant OTP-based approval. This seamless integration ensures 100% accuracy with providing members with a modern, hassle-free payment experience.

Transactions are processed automatically via API with direct real-time posting to customer accounts, significantly reducing administrative effort and transaction processing time.

Locker Facility in Co-op. Soc.

Provide a secure and managed locker facility for your members to safely store their valuables. The system manages locker allocation, rent tracking, availability status, and maintains detailed access logs.

Automate rent collection with recurring billing and generate reports for occupied vs. vacant lockers. This added service increases member retention and adds a steady revenue stream to the society.

Joint Liability Groups (JLG)

Implement the Joint Liability Group model where small groups of members co-guarantee each other's loans. This facilitates micro-lending to those without traditional collateral, fostering financial inclusion.

The system tracks group formation, leader designation, and collective repayment schedules. If one member defaults, the group responsibility logic ensures recovery, minimizing the society's credit risk.

Gold Loan – Pouch Base

Streamline gold loan processing with a comprehensive pouch-based system. Record detailed inventory of gold items, capturing photographs of both the jewelry and the storage pouch for security and audit capabilities.

Automate valuation using caret-wise rates based on the average price of the last 90-120 days. The system automatically calculates eligible loan amounts (typically 70-80% of value) based on your custom LTV policies.

KYC API Base

Enhance security and compliance with instant KYC verification using government APIs. Capture and validate member data directly from Aadhar, PAN Card, Driving License, and Passport details in real-time.

Eliminate fake documentation and data entry errors. The API integration ensures that member identities are authenticated against official databases, significantly reducing fraud risk and speeding up the onboarding process.

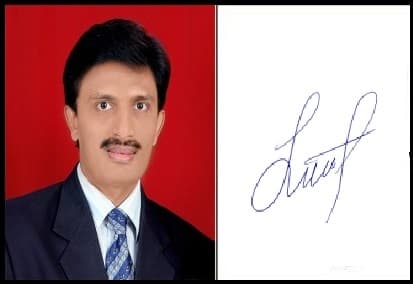

Photo & Signature

Store photographs and signatures of members and account holders in the software for easy access when needed. Loan societies can maintain photographs of guarantors, property, vehicles, gold, and other collateral.

Member photographs can be captured directly via webcam or imported from previously scanned images. The system supports multiple image formats and provides secure storage for all visual documentation.

SMS & WhatsApp Facilities

Send transaction information to members immediately via SMS or WhatsApp for events like new account opening, transactions, and account balances. This creates a positive image of your society in the market.

Use promotional SMS to advertise new schemes or products to members. Many societies also send SMS greetings on birthdays and festivals like New Year, Holi, and Rakshabandhan.

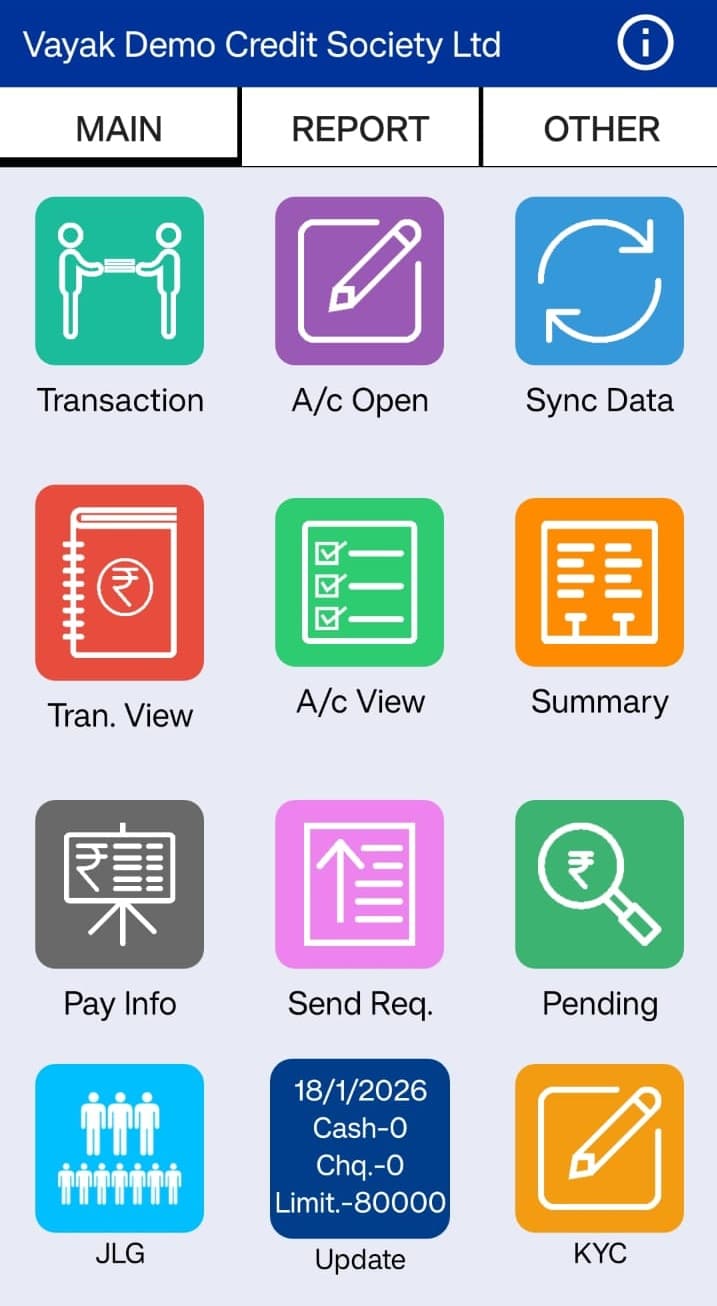

Agent Ecollect Mobile App

India's first mobile collection system eliminates the need to purchase agent collection machines. Agents only need an Android smartphone and internet connection. With decreasing mobile and internet costs, our Agent Collection Mobile App offers the most cost-effective way to work online efficiently.

Agents simply enter collections in the mobile app and sync data to the cloud server. Society staff can import all data into the software and automatically post to individual ledgers, general ledgers, and day books. SMS notifications can also be sent to customers.

Mobile App for Members

Empower your members with 24/7 access to their financial information through our comprehensive mobile application designed for Credit Co-operative Societies, Micro Finance Institutions, and Nidhi Companies.

Members can view complete society details including interest rates, profit and loss statements, and balance sheets. Access his account details, transaction history and download account statements anytime. Seamlessly transfer funds to other members, View Soc. News and send complaints.

Agent Collection M/C Connectivity Software

Agents can use daily collection machines to provide on-site printed receipts to members. When agents return to the society, simply connect their machine to the software to automatically post all data to individual ledgers, general ledgers, and day books. This eliminates manual data entry and reduces the possibility of errors in transaction recording.

Machine collection is a lengthier process compared to mobile apps, which is why societies are increasingly moving toward mobile app-based collection systems. However, both options are available to suit different society preferences and operational requirements.

Core Credit Solution (Like Core Banking)

Multi-branch or multi-state societies with more than one branch can provide customers the convenience of transacting from any branch with Vayak's Core Credit Society Solution. This facility allows members to deposit or withdraw money from any branch location.

The system maintains real-time synchronization across all branches, ensuring data consistency and accuracy. Members enjoy the flexibility of banking-like services with instant access to their accounts from any branch in the network.